Estimated Tax Payments 2024 Forms Vouchers 2024

Estimated Tax Payments 2024 Forms Vouchers 2024. What are federal estimated taxes? We do this to head off a poss.

(1) you may pay the estimated tax in one payment on or before january 15, 2024, and file your return by june 1, 2024, or (2) you may file your return and pay the tax in full by march 1, 2024.* 2024 estimated tax payment vouchers, instructions & worksheets.

Estimated Payments Can Be Made Electronically.

Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.

Alternatives To Mailing Your Estimated Tax Payments To The Irs;

What are federal estimated taxes?

Estimated Tax Payments 2024 Forms Vouchers 2024 Images References :

Source: halleyjenilee.pages.dev

Source: halleyjenilee.pages.dev

Estimated Tax Payments 2024 Forms Vouchers Gladys Lorenza, Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding. Alternatives to mailing your estimated tax payments to the irs;

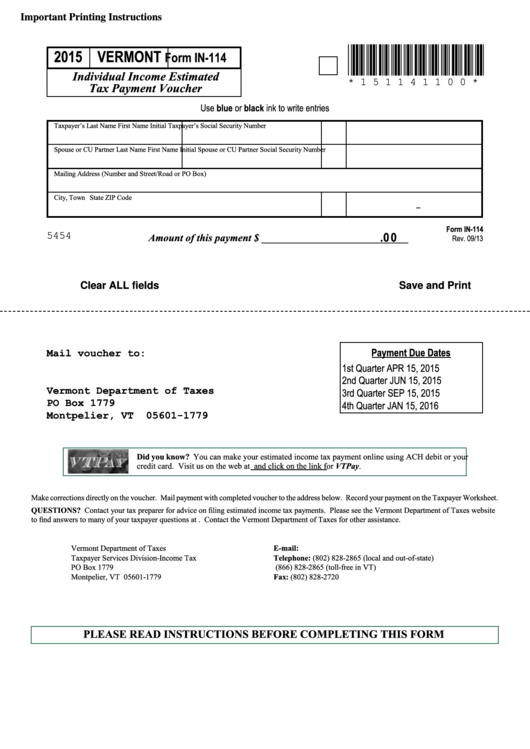

Source: ardysqmeredith.pages.dev

Source: ardysqmeredith.pages.dev

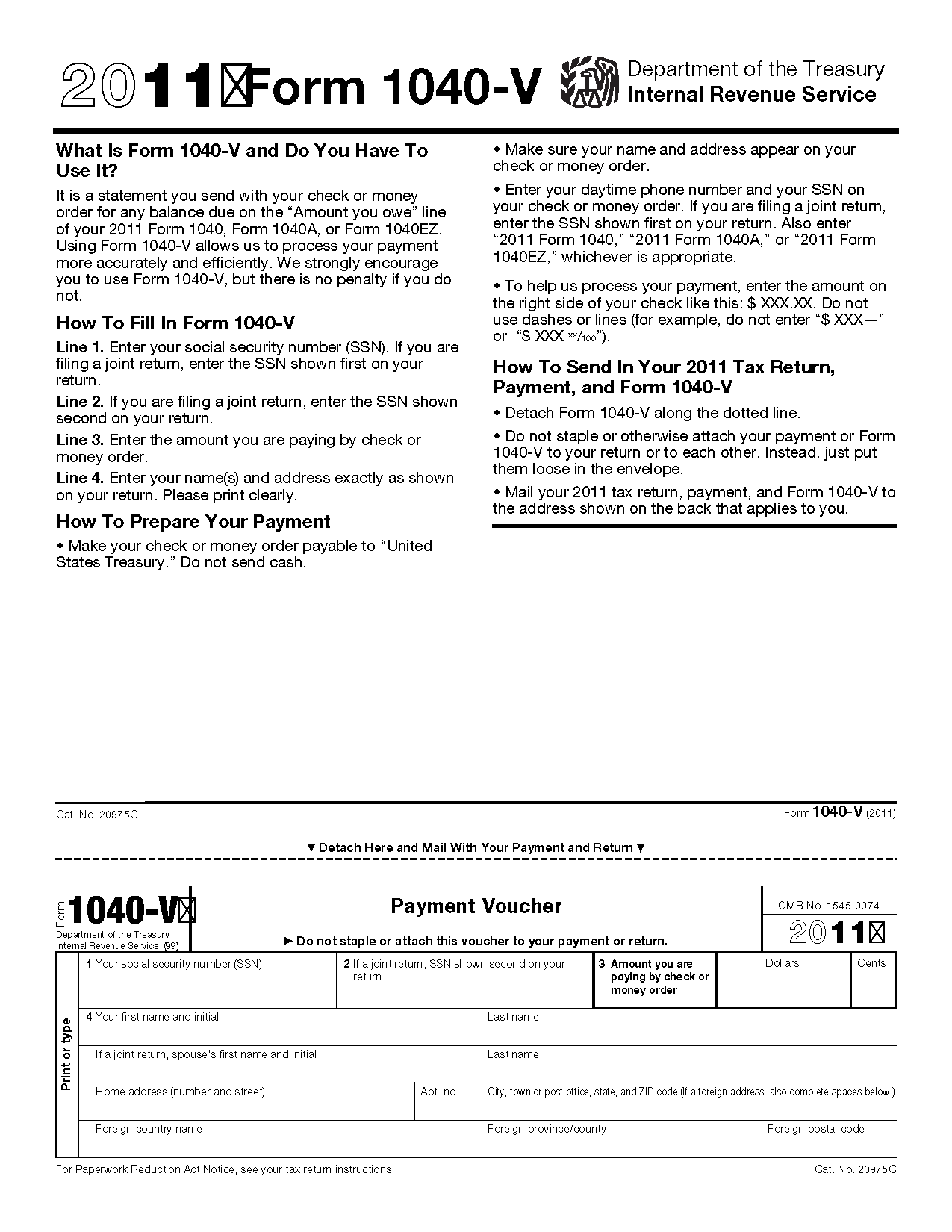

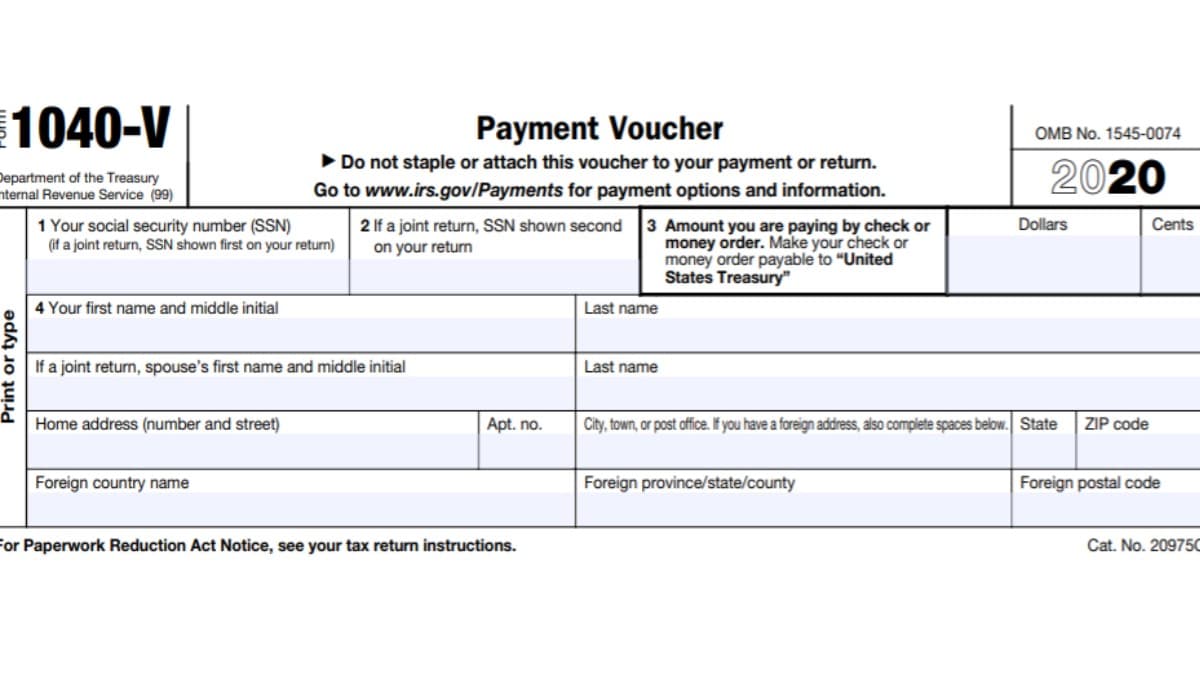

Irs Estimated Tax Payment Form 2024 Deana Estella, Alternatives to mailing your estimated tax payments to the irs; These payments are crucial for the 2024 tax year due to potential tax law changes and to avoid underpayment penalties.

Source: www.signnow.com

Source: www.signnow.com

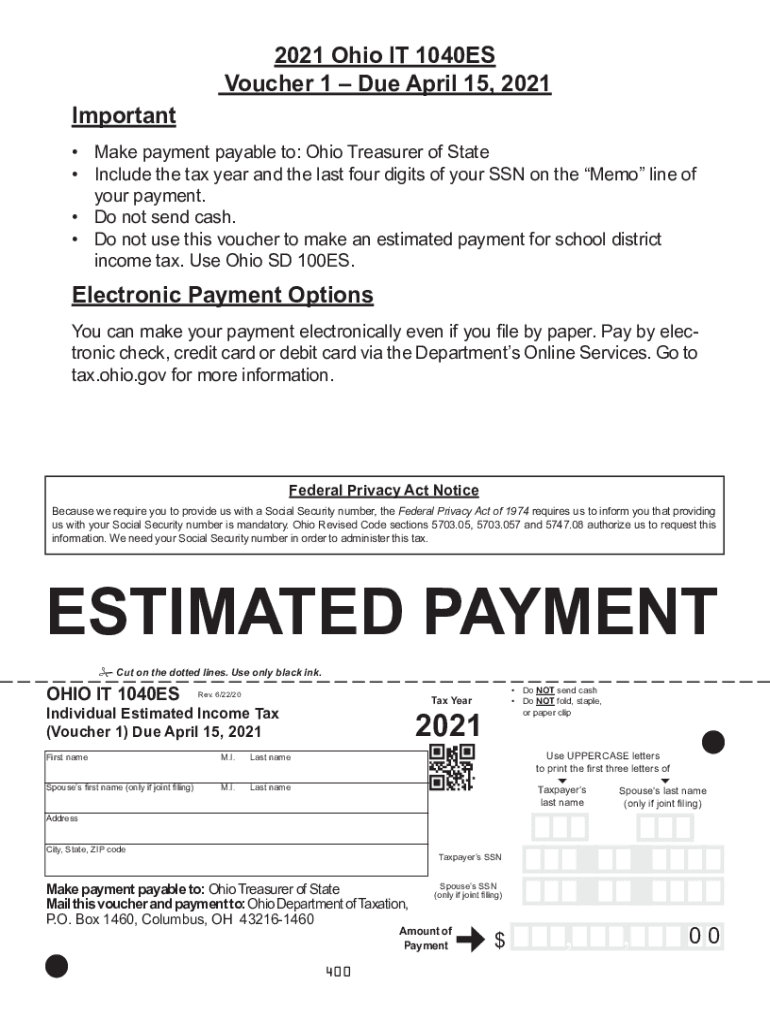

Ohio Estimated Tax 20212024 Form Fill Out and Sign Printable PDF, Sign in to your turbotax account, then open your return by selecting continue or pick up where you left off in the progress tracker. Estimated payments can be made electronically.

Source: debeeqardelia.pages.dev

Source: debeeqardelia.pages.dev

2024 Form 1040Es Payment Voucher 1 Arlena Olivia, If your turbotax navigation looks different from what’s described here, learn more. If you won't have the same income, you can either lower the amount of estimated taxes, or skip paying them.

Source: ailisqdierdre.pages.dev

Source: ailisqdierdre.pages.dev

Irs 2024 Form 1040Es Payment Voucher Esme Janenna, This budget, which marks her seventh consecutive presentation, outlines the government’s financial strategy and priorities for the upcoming year. If you are required to make estimated payments, yes, you can pay them anytime before the due date without penalty.

Source: kiahqauguste.pages.dev

Source: kiahqauguste.pages.dev

2024Es 2024 Estimated Tax Payment Vouchers Dulcie Violet, Estimated payments can be made electronically. Fillable 1040 es form printable forms free online, if you expect to owe $200 $2000, then you should remit estimated tax payments of $500 per quarter.

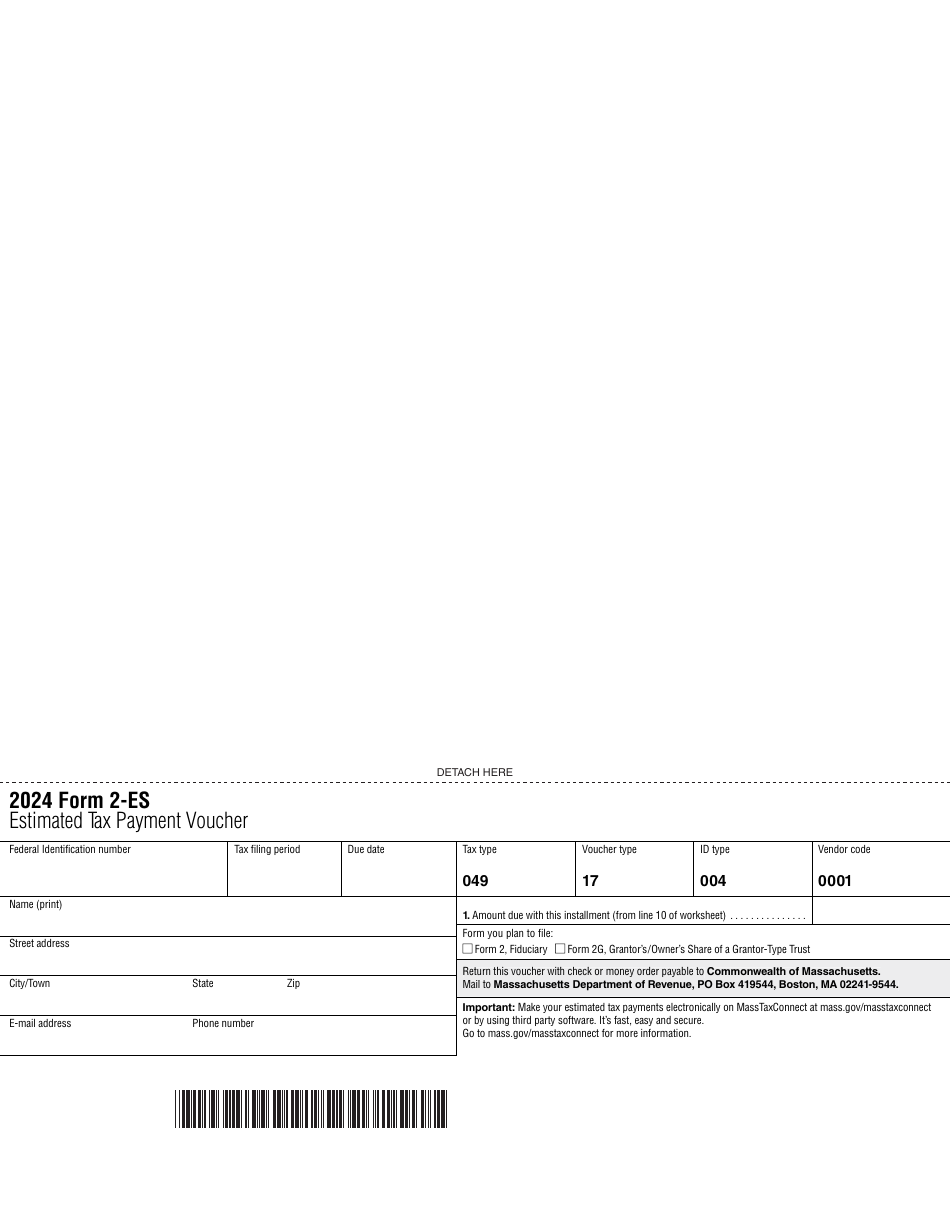

Source: www.templateroller.com

Source: www.templateroller.com

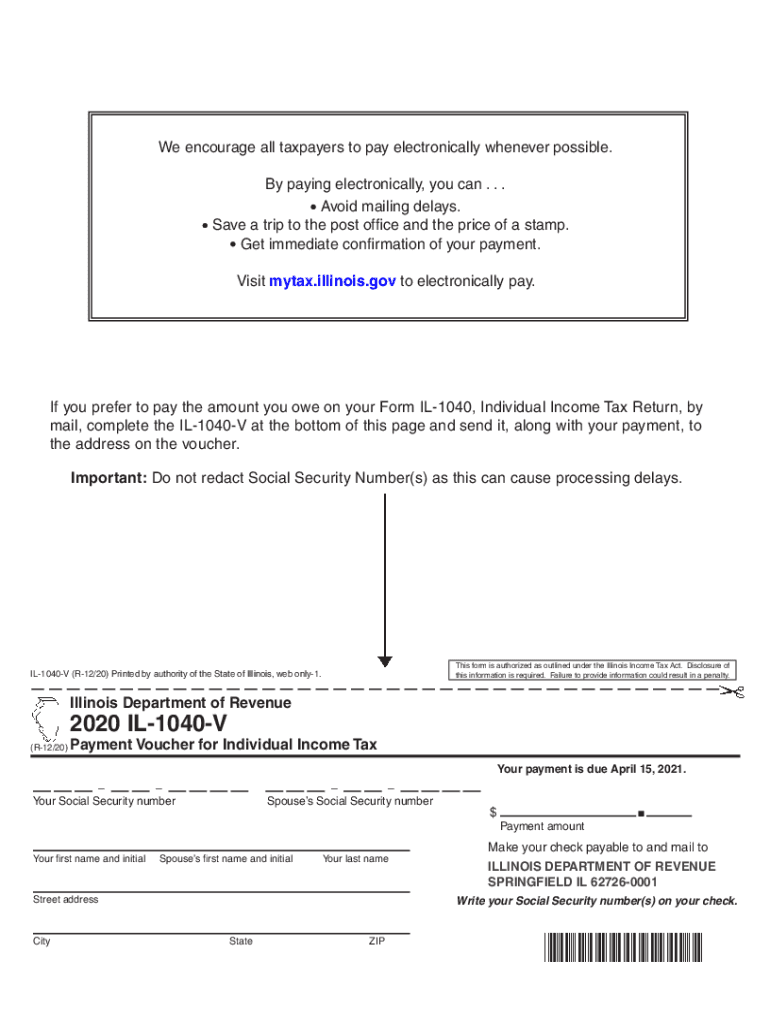

Form 2ES Download Printable PDF or Fill Online Estimated Tax Payment, Estimated tax is the method used to pay tax on income that is not subject to withholding. Sign in to your turbotax account, then open your return by selecting continue or pick up where you left off in the progress tracker.

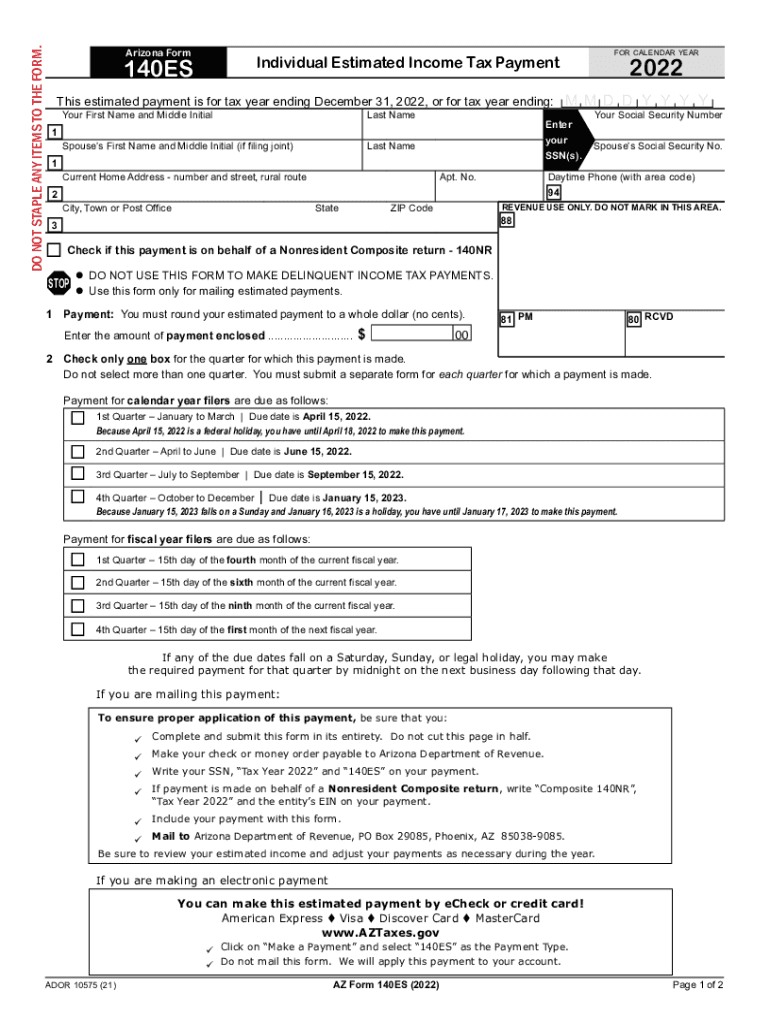

Source: www.signnow.com

Source: www.signnow.com

Arizona 140es 20222024 Form Fill Out and Sign Printable PDF Template, If your turbotax navigation looks different from what’s described here, learn more. If you are required to make estimated payments, yes, you can pay them anytime before the due date without penalty.

Source: konstanzewallys.pages.dev

Source: konstanzewallys.pages.dev

Estimated Tax Payment Vouchers 2024 Jena Robbin, Use this form if you are required to make estimated income tax payments. Alternatives to mailing your estimated tax payments to the irs;

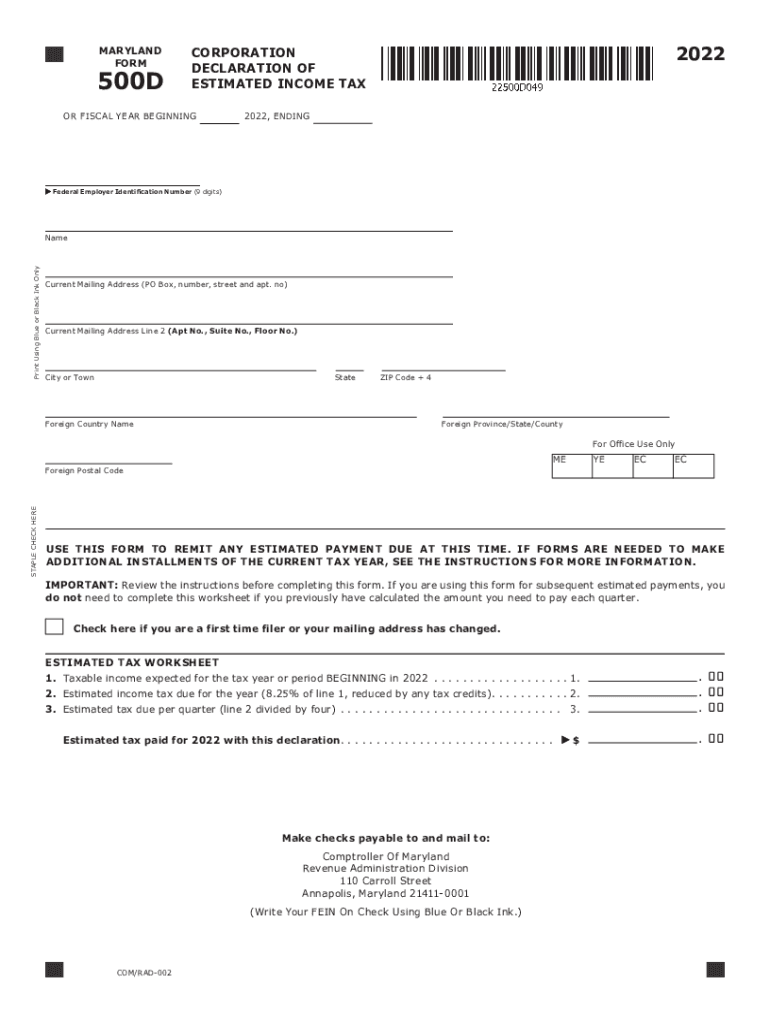

Source: kialqcacilie.pages.dev

Source: kialqcacilie.pages.dev

State Of Maryland Estimated Tax Payments 2024 ashly lizbeth, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding. These vouchers aren't reported to the irs.

(1) You May Pay The Estimated Tax In One Payment On Or Before January 15, 2024, And File Your Return By June 1, 2024, Or (2) You May File Your Return And Pay The Tax In Full By March 1, 2024.*

You are required to pay estimated income tax if the tax shown due on your return, reduced by your north carolina tax withheld and allowable tax credits, is $1,000 or more regardless of the amount of income you have that is not subject to withholding.

90% Of Your Estimated 2024 Taxes;

In the intricate realm of tax regulations.

Posted in 2024